Global Financial “Meltdown” – One Of The Best Financial Crisis Documentary Films (2 hours 49 minutes)

– 1,631,166 views on Rebel Mystic YouTube channel as of August 5, 2017 –

– “The Secret History of the Global Financial Collapse” film of 2010 –

Description

“Meltdown” (a disastrous event, especially a rapid fall in share prices) is a four-part investigation leading us into a world of immense greed and recklessness that had lead to a sudden collapse of the financial world. The film begins with the 2008 crash that forced 30 million people into unemployment, pushed some countries to the abyss of insolvency and turned the clock back to the times of the year 1929.

But what were the reasons that everything got so bad? Lack of government regulation, which made the easy lending in the US housing market possible, meant anyone could easily qualify for getting a home [housing] loan. Also, London was competing with New York for the position of the banking capital of the world. And the British finance minister of that time, Gordon Brown instituted a light touch type of regulation – so letting bankers to have a free hand in the marketplace.

“Meltdown” continues with the examination of the infection of fear that caused the banks to stop lending, and then how the people began their fight with the banks. Finally, the film asks how the world can prepare for the next crisis despite the fact that this crisis is not over yet.

Among the protagonists we have an Arab ruler who says the crash of the financial market never happened, a king of “Wall Street” who is charged with fraud, a woman representative of the U.S. Congress who wants to jail the bankers, as well as some among the world leaders who want to re-think capitalism.

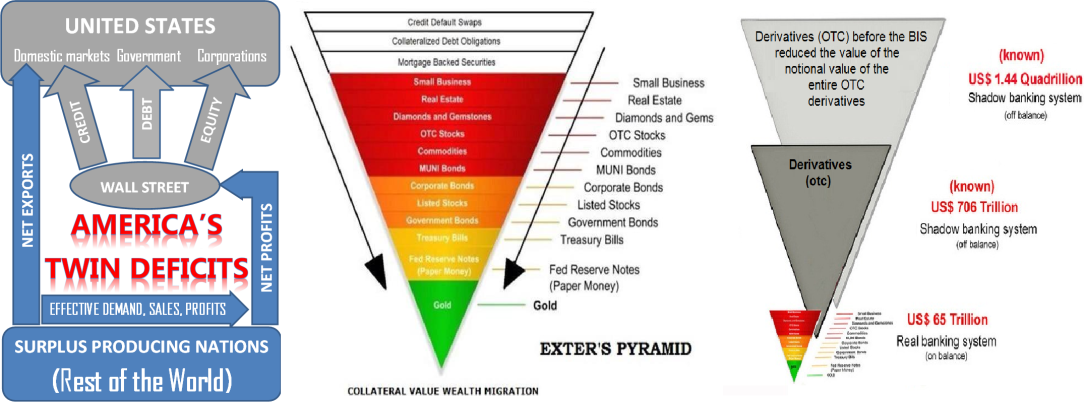

The true background, however, is different from this description. I’ve found that the whole crisis of the 2007-08 years had been created by United States’ international policy which had been recycling the global surpluses of other nations via Wall Street to cover its own deficits. And even more, they had an actual process with which a given type of Exter’s pyramid had been built up to the years of 2007-08. So they had have a huge financial bubble on the market, that had not been covered properly at all. (Click to enlarge the illustration seen below!)

Sources for more information:

– Exter’s Pyramid, articles on WikiPedia in: English • Français • Magyar

– Notional value, articles on WikiPedia in: English • Français • Lietuvių

– Over-the-counter (OTC), articles on WikiPedia in: English • Беларуская • Català • Čeština • Deutsch • Español • فارسی • Français • 한국어 • Հայերեն • हिन्दी • Italiano • עברית • Lietuvių • Nederlands • 日本語 • Norsk bokmål • Polski • Português • Русский • Suomi • Svenska • Türkçe • Українська • Tiếng Việt • 中文

– Goldman Sachs, Citibank, JP Morgan Chase, Bank Of America Have Assets of $5 trillion & Carry $235 TRILLION In Risk Exposure, 1/3 Of World Total, The Oldspeak Journal, Oct 4, 2011

– Rob Kirby: The Financial Derivatives Market Will Collapse Soon!, May 20, 2014

– Articles tagged -derivatives- on the The Economic Collapse site with the current latest Financial Weapons Of Mass Destruction: The Top 25 U.S. Banks Have 222 Trillion Dollars Of Exposure To Derivatives of May 15, 2017

– Derivatives, articles on WikiPedia in: English • العربية • Български • Català • Čeština • Dansk • Deutsch • Eesti • Ελληνικά • Español • Esperanto • Euskara• فارسی • Français • 한국어 • Հայերեն • हिन्दी • Hrvatski • Bahasa Indonesia • Íslenska • Italiano • עברית • ಕನ್ನಡ • Қазақша • Latina • Lietuvių • Magyar • Македонски • Nederlands • 日本語 • Norsk bokmål • Plattdüütsch • Polski • Português • Română • Русский • Simple English • Slovenčina • Suomi • Svenska • Татарча/tatarça • ไทย • Türkçe • Українська • Tiếng Việt • 粵語 • 中文

– Yanis Varoufakis on the decision to manage the actual crisis of capitalism by managing the surplus of global capitalism (4 min)

Excerpt created for my own Sandor Nacsa YouTube channel from the presentation of the book “The Global Minotaur: America, Europe and the Future of the Global Economy” on May 15, 2013 (see also with language subtitles: in Russian, in Hungarian)

– Paul Volcker, articles on Wikipedia in: English • العربية • Català • Deutsch • Español • فارسی • Français • 한국어 • Hrvatski • Bahasa Indonesia • Italiano • עברית • Nederlands • 日本語 • Norsk bokmål • Polski • Português • Русский • Simple English • Suomi • Українська • 中文

– A world without the Global Minotaur: Why is the world economy failing to recover?, post by Yanis Varoufakis, Nov 10, 2012

– UNITED STATES MONETARY POLICY IN THE POST-BRETTON WOODS ERA Did it cause the Crash of 2008? 51 pages long research paper by Yanis Varoufakis, Nov 24, 2013

– The Global Minotaur, book by by Yanis Varoufakis, 2011 (1st edition), 2013 (3d edition), July 5, 2015 (3d edition)

– Chapter 3: The Global Plan (from the 1st, 2011 edition of The Global Minotaur)

– What is a Surplus Recycling Mechanism? An idea going back to Bretton Woods, post by Yanis Varoufakis, Feb 9, 2011

– Surplus recycling, currency unions and the birth of the Global Minotaur, post by Yanis Varoufakis, Feb 10, 2011

– The Global Minotaur as a most peculiar Global Surplus Recycling Mechanism, post by Yanis Varoufakis, Feb 15, 2011

– Henry Kissinger, articles on Wikipedia in: English • العربية • Asturianu • Azərbaycanca • تۆرکجه • বাংলা • Беларуская • Беларуская (тарашкевіца) • Български • Bosanski • Català • Čeština • Cymraeg • Dansk • Deutsch • Eesti • Ελληνικά • Español • Esperanto • Euskara • فارسی • Français • Frysk • Gaeilge • Galego • 한국어 • Հայերեն • Hrvatski • Ido • Bahasa Indonesia • Íslenska • Italiano • עברית • Kapampangan • ქართული • Kurdî • Latina • Latviešu • Lietuvių • Magyar • Malagasy • മലയാളം • Bahasa Melayu • မြန်မာဘာသာ • Nederlands • नेपाली • 日本語 • Norsk bokmål • Oʻzbekcha/ўзбекча • ਪੰਜਾਬੀ • پنجابی • Polski • Português • Română • Русский • Sardu • Scots • Shqip • Simple English • Slovenčina • Slovenščina • Soomaaliga • کوردی • Српски / srpski • Srpskohrvatski / српскохрватски • Suomi • Svenska • Tagalog • தமிழ் • ไทย • Türkçe • Українська • اردو • Tiếng Việt • Winaray • Yorùbá • 中文